Filing income taxes don’t have to be complicated if you’re a blogger or freelancer. We’ll break down the biggest misconceptions about what counts as income, how to handle business travel and how having a home office can influence your tax responsibility. Be sure to share these Income Tax Tips for Bloggers in your blogging and networking communities online.

When you’re a full-time employee, your employer tracked your income all year long. You receive a W-2 that documented your income, state and federal taxes, retirement and medical expenses and other deductions. It was super simple to enter this information into tax software or forms, file your taxes and move on with life. When you’re a blogger or freelancer, things can get more complicated because your income comes from various sources. It’s your responsibility to document your income, track expenses, keep track of gains and losses, and if necessary pay your taxes quarterly.

Disclaimer: Consult a qualified, licensed and reliable tax professional with your income tax questions. You can also use accounting software to track your income, losses, and gains. Visit Irs.gov Small Business Self-Employed Tax Center resources online.

Income Tax Tips for Bloggers

What counts as income?

Vendors may ask you to submit a W-9 form which requires them to send you a 1099-K tax form if they paid $600 or more in a calendar year.

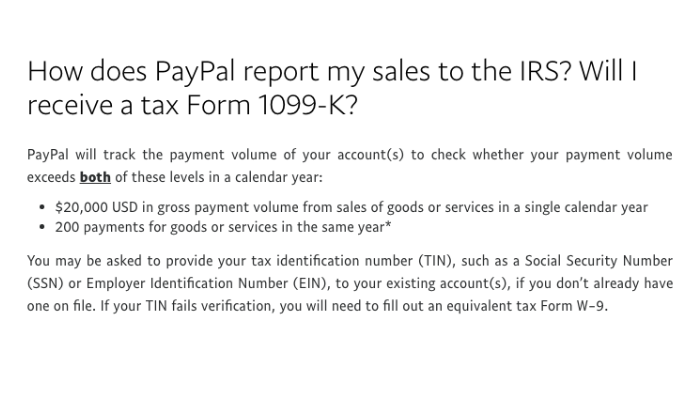

Paypal will send you a 1099-K form if you receive more than $20,000 in gross payment and if you had 200 payments through its system in a year. Visit the PayPal Tax Center for more information.

But there are additional items you need to estimate and count in your income, including:

- Sponsored posts

- Giveaways

- Products (for review)

- Gift cards

- Affiliate income

- Swag (yes, swag from conferences and events IS income.)

What counts as business expenses?

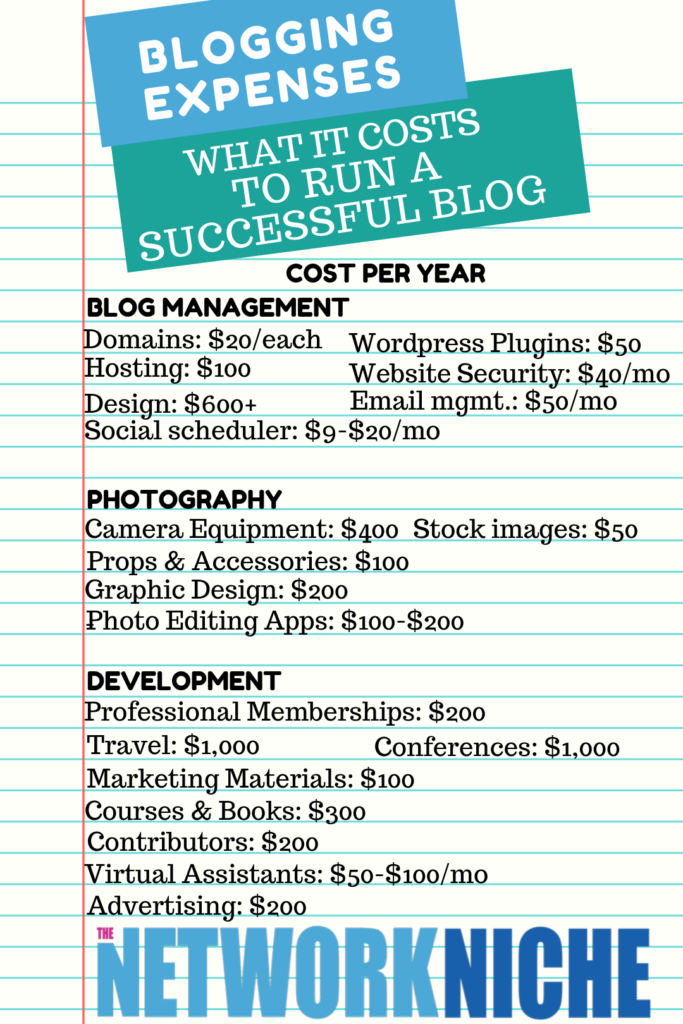

When you earn income as a blogger or freelancer, running your own business comes with expenses, including but not limited to:

- Hosting

- WordPress plugins

- WordPress design

- Website security

- Social schedulers

- Advertising

- Virtual assistants

- Contributors

- Photography equipment

RELATED POST: What It Costs to Run a Successful Blog [Infographic]

Bloggers travel for business too, especially to social media and blogging conferences.

Business travel expenses can include:

- Conference fees

- Airfare

- Hotel

- Food

- Airport transportation

- Books & Courses

Can my home office influencer my tax responsibility?

According to the IRS, your home office can qualify for a deduction, “If you use part of your home for business, you may be able to deduct expenses for the business use of your home. The home office deduction is available for homeowners and renters, and applies to all types of homes.”

Your home office needs to meet two (2) qualifying requirements.

- You must use it regularly and exclusively as a home office.

- Although you may meet clients other places and conduct business on the go, your home office can be your regular place to do business and still qualify for a home office deduction.

Talk to your tax professional about using Form 8829 regarding home office business expenses.

Bonus Tax Tips:

Keep separate bank accounts. Keep your personal bank account & blogging income bank (or business) account separate. Many banks offer free or low-cost business bank accounts. If you’re a member of a credit union, you can also qualify for free or low-cost business accounts.

Start early. Start each year with a focus on tracking your income and expenses so filing your taxes are easier.

File an extension. Nothing makes you feel worse than the looming April tax deadline each year. If necessary, file a tax extension. You will still need to estimate your tax responsibility and submit it with your tax extension application. Fines and fees may apply.

Know important tax terms like self-employment tax (SE). The IRS has helpful definitions on the Self-Employed Individuals Tax Center:

” As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly.

Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax (like income tax).”

Use bookkeeping and accounting software: Quickbooks Self Employed (starting at $7/month) is a popular option for entrepreneurs who have to track their income and expenses, plus has invoicing capabilities. FreshBooks ($7.50/month) is a similar software option. Note – the cost of tracking your income and filing taxes can be included in your business expenses.

We have a supportive Facebook group for The Network Niche influencers where you can ask questions and share your expertise.

Would you like to learn more about growing your influencer as a content creator? Would you like to be connected to brands for paid sponsorships and invited to cover events in your region?

Join The Network Niche influencer agency, by adding your blog’s name, contact information and your blog’s stats so we can find the perfect fit for future brand collaborations.

No Comments